CA UBEN 106 2022-2024 free printable template

Show details

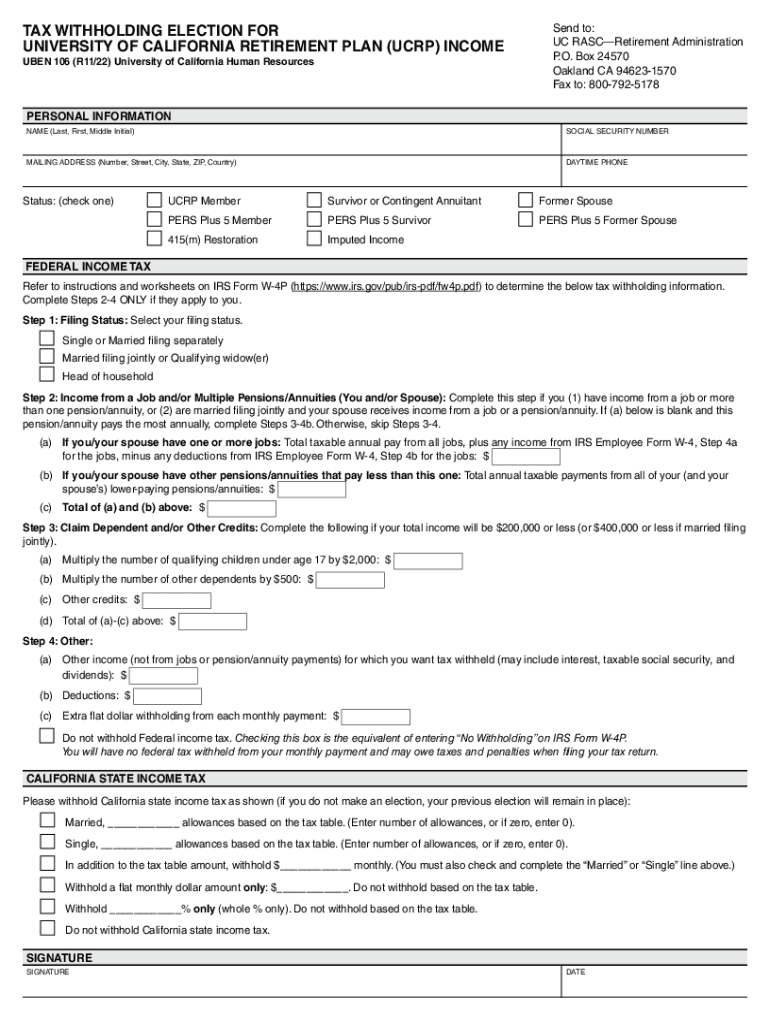

TAX WITHHOLDING ELECTION FOR UNIVERSITY OF CALIFORNIA RETIREMENT PLAN (CRP) INCOME BEN 106 (R11/22) University of California Human Resources laws and UC policies governing tax withholding vary according

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your tax withholding election form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax withholding election form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax withholding election form online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit california tax withholding plan form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

CA UBEN 106 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tax withholding election form

How to fill out tax withholding election form:

01

Obtain the tax withholding election form from your employer or the appropriate government agency.

02

Carefully read the instructions provided with the form to understand the purpose and requirements.

03

Provide your personal information such as full name, social security number, and contact details in the designated sections of the form.

04

Determine your filing status, whether it is single, married filing jointly, married filing separately, or head of household, and indicate it on the form.

05

Calculate and enter the total number of allowances you wish to claim for withholding purposes. This depends on your marital status, number of dependents, and other factors that can impact your tax liability.

06

If you are subject to additional withholding, such as for supplemental wages or state taxes, indicate the desired amount or percentage to be withheld.

07

If you wish to request a specific additional amount of federal income tax to be withheld from each paycheck, indicate it on the form.

08

Review all the information you have entered on the form to ensure accuracy and completeness.

09

Sign and date the form, certifying that the information provided is correct to the best of your knowledge.

10

Submit the completed form to your employer or the relevant government agency as instructed.

Who needs tax withholding election form:

01

Employees who want to adjust the amount of federal income tax withheld from their paychecks.

02

Individuals who have experienced changes in their personal or financial circumstances that may affect their tax liability.

03

People who want to claim certain tax allowances or exemptions that might reduce their tax burden.

04

Individuals who wish to request additional withholding for various reasons, such as higher tax liability, state tax obligations, or supplemental wages.

05

Anyone who needs to comply with the tax withholding requirements set by the government or their employer.

Fill california withholding plan : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax withholding election form?

A tax withholding election form is a document that is typically completed by an employee to determine how much income tax should be withheld from their paycheck. The form usually includes information such as the employee's filing status, number of dependents, and any additional withholding amounts requested by the employee. The purpose of the form is to inform the employer about the employee's tax withholding preferences so that the correct amount of tax can be withheld from their wages throughout the year.

Who is required to file tax withholding election form?

Individuals who are employed and receive income from wages, salaries, tips, or other compensation are generally required to file a tax withholding election form. This form, typically Form W-4 in the United States, is used by employees to indicate their tax withholding preferences to their employer. The employer then uses this information to calculate and withhold the appropriate amount of federal income tax from the employee's paycheck. It is important for employees to accurately complete this form to ensure the correct amount of taxes are withheld throughout the year.

How to fill out tax withholding election form?

To fill out a tax withholding election form, follow these steps:

1. Obtain the form: You can usually obtain the tax withholding election form from your employer's human resources department or payroll department. If you're self-employed, you can download the form from the Internal Revenue Service (IRS) website.

2. Personal information: Fill in your personal information, such as your full name, address, Social Security number, and employment start date.

3. Filing status: Indicate your filing status, such as single, married filing jointly, married filing separately, or head of household. Your filing status determines the tax rates and deductions applicable to you.

4. Allowances: Determine the number of allowances you want to claim. Each allowance corresponds to a certain amount of tax to be withheld from your paycheck. The more allowances you claim, the less tax will be withheld. Use the worksheet on the form or the IRS withholding calculator to determine the appropriate number of allowances.

5. Additional withholding: If you want your employer to withhold an additional amount of tax from each paycheck, enter this amount in the appropriate field.

6. Sign and date: Sign and date the form to certify that the information provided is accurate and complete.

7. Submit the form: Return the completed form to your employer's payroll department or HR department. If you're self-employed, keep a copy for your records.

Remember, it's important to review and update your tax withholding election form regularly to ensure that the correct amount of tax is being withheld from your income. If your circumstances change, such as due to marriage, divorce, or significant increase in income, you may need to update your withholding elections.

What is the purpose of tax withholding election form?

The purpose of a tax withholding election form is to allow an individual to specify how much tax should be withheld from their income by their employer. This form typically includes options for the individual to choose their filing status, the number of allowances they are claiming, and whether they want any additional withholding. By completing this form, individuals can ensure that the appropriate amount of income tax is deducted from their paycheck throughout the year in order to meet their tax liabilities.

What information must be reported on tax withholding election form?

The information that must typically be reported on a tax withholding election form includes:

1. Personal information: This includes the employee's name, address, Social Security number or taxpayer identification number, and contact details.

2. Filing status: The employee must indicate their marital status for tax purposes, such as whether they are single, married filing jointly, married filing separately, or head of household.

3. Allowances: The employee must specify the number of allowances they are claiming. This determines the amount of tax to be withheld from their pay. More allowances mean less tax withholding, while fewer allowances mean more tax withholding.

4. Additional withholding: If the employee wants additional taxes withheld from their paycheck, they can specify a dollar amount or a percentage to be withheld in addition to the standard withholding.

5. Exempt status: If the employee qualifies for exempt status, they can indicate this on the form. Exempt status indicates that no federal income tax will be withheld from their wages.

6. Signature and date: The employee must sign and date the form to confirm that the information provided is accurate.

Note that the specific details required on a tax withholding election form may vary depending on the country and jurisdiction. This response is based on the assumptions that the question refers to the United States.

What is the penalty for the late filing of tax withholding election form?

The penalty for the late filing of the tax withholding election form will depend on the specific tax laws and regulations of the country or jurisdiction in question. In the United States, for example, if an employer fails to file Form W-4 (Employee's Withholding Allowance Certificate) or an equivalent state form, they may be subject to penalties imposed by the Internal Revenue Service (IRS).

These penalties can include monetary fines for each form not filed, the potential for backup withholding at the maximum tax rate, and potential civil or criminal actions if the non-filing is determined to be intentional or fraudulent. It is important to consult the tax laws and regulations of the relevant jurisdiction to understand the specific penalties that may apply.

How can I edit tax withholding election form on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing california tax withholding plan form.

How do I fill out the california withholding plan form form on my smartphone?

Use the pdfFiller mobile app to fill out and sign ca withholding plan form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I complete california withholding plan income form on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your california withholding retirement form by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your tax withholding election form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Withholding Plan Form is not the form you're looking for?Search for another form here.

Keywords relevant to tax withholding plan form

Related to ca withholding election income form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.